Unlocking the Blueprint to Realty: A Beginner's Guide

Embarking on a journey from blueprint to realty requires a clear understanding of the foundational steps involved in transforming conceptual designs into tangible properties. The blueprint to realty process begins with envisioning your goals, whether it's developing a residential complex or a commercial space. This pathway not only demands strategic planning but also integrates key elements like real estate investment to ensure long-term viability. In this article, we'll explore how to navigate this intricate process, making it accessible for aspiring developers and investors alike.

The initial phase of any blueprint to realty endeavor involves thorough market research and site selection. Identifying the right location is crucial, as it directly impacts the property's future value and appeal. For instance, consider factors such as accessibility, neighborhood growth potential, and zoning regulations. Once the site is chosen, architectural blueprints are drafted, outlining the structure's layout, materials, and sustainability features. Here, real estate investment plays a pivotal role, as securing funding through loans, partnerships, or personal capital is essential to move forward. Without a solid financial blueprint, even the most innovative designs risk remaining on paper.

Navigating Financing and Legal Hurdles in Blueprint to Realty

Financing is the backbone of turning a blueprint into realty, and understanding various options can make or break your project. Traditional bank loans, private investors, or government grants tailored for real estate investment are common avenues. It's advisable to consult with financial advisors to craft a budget that accounts for construction costs, permits, and unexpected contingencies. Legally, obtaining necessary approvals from local authorities ensures compliance with building codes and environmental standards. Delays in this stage can escalate expenses, so proactive engagement with lawyers specializing in real estate is recommended.

Moreover, incorporating sustainable practices into your blueprint to realty plan can attract eco-conscious investors and enhance property value. Features like energy-efficient materials and green spaces not only reduce operational costs but also align with modern real estate investment trends. For example, properties with solar panels or rainwater harvesting systems often command higher rental yields, making them a smart choice for long-term portfolios.

Construction Execution: From Blueprint to Realty

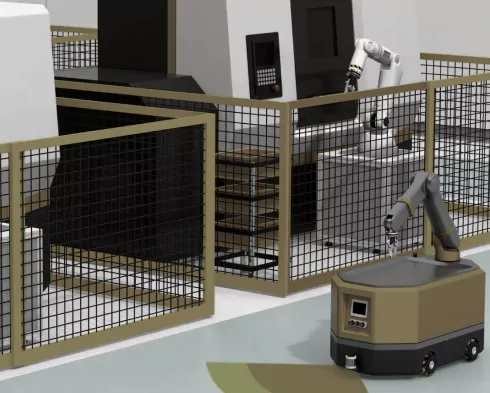

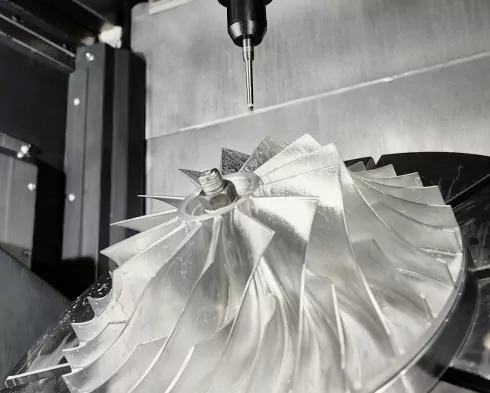

With blueprints approved and funding in place, the construction phase brings the blueprint to realty to life. Hiring a reliable contractor experienced in real estate projects is key. They oversee the timeline, ensuring that each phase—from foundation laying to finishing touches—adheres to the original design. Regular site inspections help mitigate issues like material shortages or weather delays, keeping the project on track. Throughout this process, real estate investment strategies evolve; investors might explore value-add opportunities, such as adding amenities that boost marketability.

Effective project management tools, including software for tracking progress and budgets, streamline operations. Communication between architects, engineers, and builders is vital to avoid costly revisions. As the structure takes shape, it's an exciting time to envision the end result—a functional, revenue-generating asset born from meticulous planning.

Post-Construction: Maximizing Returns on Your Blueprint to Realty Investment

Once construction wraps up, the blueprint to realty transformation culminates in occupancy and monetization. For residential properties, marketing through online platforms and open houses can quickly fill units. Commercial spaces might require tenant negotiations to secure leases that provide steady income. Real estate investment in this stage focuses on property management, maintenance, and scaling up to additional projects.

To maximize returns, conduct a post-completion audit to assess what worked and what could be improved for future endeavors. Tax implications, insurance, and resale potential should also be evaluated. Successful investors often reinvest profits into new blueprints, creating a cycle of growth. By understanding the blueprint to realty process holistically, you position yourself for sustained success in the competitive real estate landscape.

Common Pitfalls and How to Avoid Them in Real Estate Investment

While the blueprint to realty journey is rewarding, pitfalls like overleveraging or ignoring market fluctuations can derail progress. Diversifying your real estate investment portfolio mitigates risks, balancing high-yield opportunities with stable assets. Stay informed about economic trends, such as interest rate changes, that affect financing. Networking with industry professionals through associations or seminars provides insights and potential partnerships.

Another frequent challenge is underestimating soft costs, like design fees or marketing expenses. Budgeting an additional 10-20% buffer is a prudent real estate investment tactic. By learning from case studies of successful developments, you can anticipate obstacles and refine your approach, ensuring your blueprint to realty vision becomes a profitable reality.

The Future of Blueprint to Realty in Evolving Markets

Looking ahead, technology is reshaping the blueprint to realty process. Virtual reality tools allow for immersive blueprint walkthroughs, aiding investor buy-in before groundbreaking. Smart city initiatives are driving demand for innovative real estate investment, such as mixed-use developments that integrate living, working, and leisure spaces.

Sustainability remains a cornerstone, with green building certifications becoming standard. As urban populations grow, the blueprint to realty framework will emphasize adaptive reuse of existing structures, reducing environmental impact while capitalizing on real estate investment opportunities. Aspiring developers should embrace these trends to stay ahead, turning visionary blueprints into enduring legacies.

In summary, the blueprint to realty path, intertwined with strategic real estate investment, demands patience, expertise, and adaptability. By following these steps—from ideation to execution—you can build not just properties, but a thriving portfolio that stands the test of time. Whether you're a novice or seasoned investor, this comprehensive approach equips you to navigate the complexities and reap the rewards.